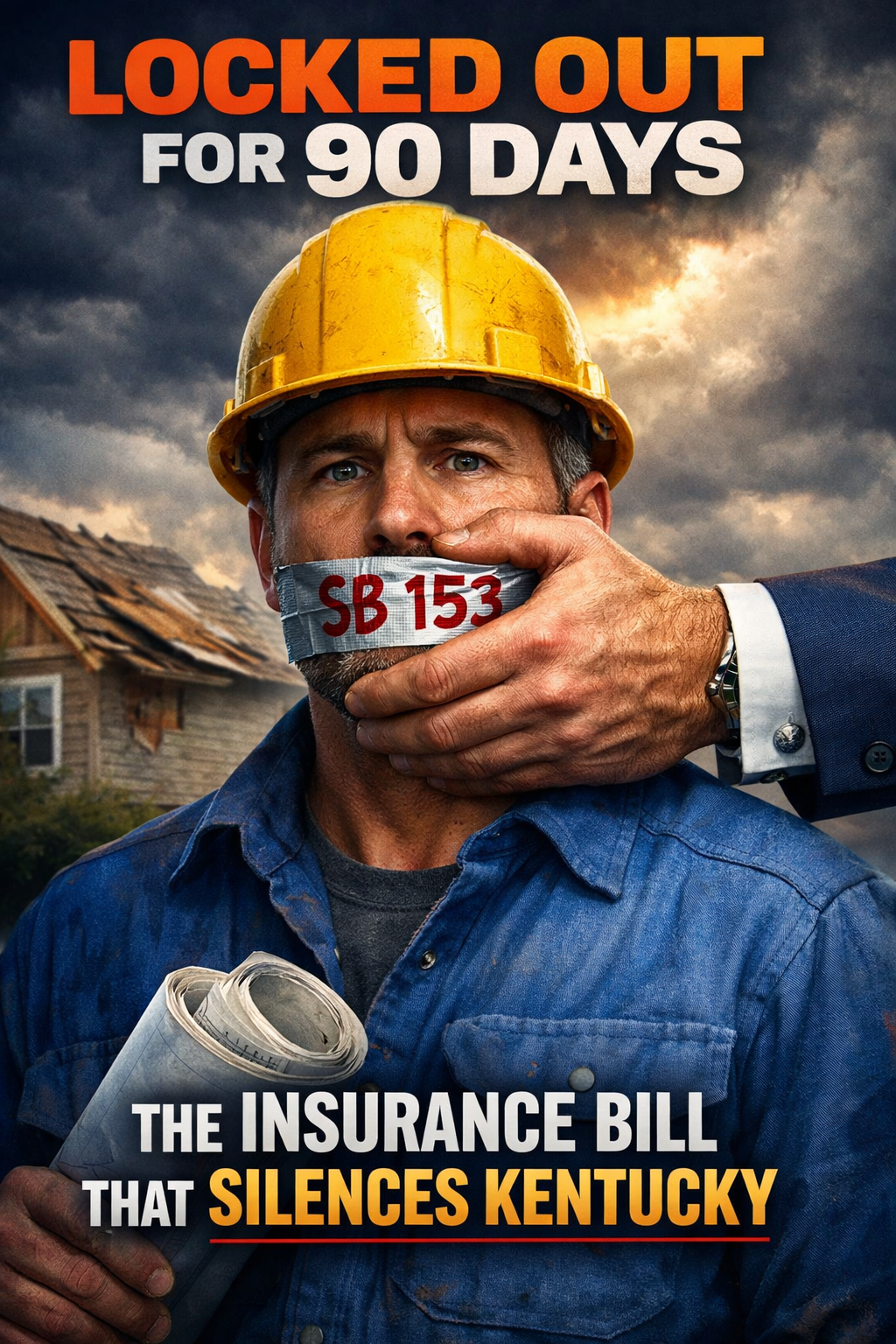

Locked Out for 90 Days: How Insurance Companies Are Using Kentucky SB 153 to Kill Competition—and Why Your Roof Repair Bill Is Next

When a tornado rips through Bowling Green or hail pelts Louisville, the immediate danger fades. But for homeowners, a new battle begins: getting paid to fix the damage.

You might think the biggest threat is the weather. But according to a controversial bill moving through the Kentucky Legislature—Senate Bill 153 (SB 153) —the biggest threat is actually the contractor knocking on your door.

While SB 153 is marketed as a “consumer protection” measure, a deep dive into the funding and legislative history reveals a very different story. Here is how the insurance industry is bankrolling this bill, why they are desperate to silence contractors for 90 days, and what it really means for your home.

What is SB 153? The “Cooling Off” Period That Isn’t For You

At its core, SB 153 makes it illegal for contractors to solicit residential repair work for 90 days following a declared disaster.

What it claims to do:

- Prevent “storm chasers” from price gouging vulnerable homeowners.

- Reduce fraudulent claims where contractors invent damage.

- Lower insurance premiums for everyone.

What it actually does:

- Grants insurance companies a 90-day monopoly on damage assessment.

- Prevents homeowners from getting competitive bids.

- Forces you to accept the insurance adjuster’s valuation without a second opinion.

The Money Trail: Who is Behind SB 153?

Contractors don’t have armies of lobbyists in Frankfort. Insurance companies do.

This bill didn’t originate on a concerned citizen’s laptop. It was drafted by trade associations funded by multi-billion dollar carriers. The primary drivers are:

1. The American Property Casualty Insurance Association (APCIA)

APCIA represents insurers writing over $775 billion in annual premiums. They have made “anti-assignment of benefits” (AOB) and “post-disaster solicitation bans” their national legislative priority. Kentucky is simply the latest battleground.

2. NAMIC (National Association of Mutual Insurance Companies)

This group represents mutual insurers like State Farm and Auto-Owners. They have flooded Kentucky lawmakers with campaign contributions specifically tied to tort reform and claims restriction.

3. The “Front Groups”

You won’t see a press release that says “State Farm Wants You to Wait 90 Days.” Instead, the funding flows to groups with folksy, trustworthy names like:

- The Coalition Against Insurance Fraud

- Kentuckians for Legal Reform

These groups are funded almost entirely by insurance premiums. They are not grassroots; they are “Astroturf.”

Why 90 Days? The Strategy of Starvation

To understand why insurers need ninety days, you have to understand the “Claims Lifecycle.”

Day 1-30: The homeowner files a claim. The insurer sends their own adjuster. They write an estimate based on proprietary software (like Xactimate). This estimate is usually low—it accounts for depreciation and often misses hidden damage.

Day 30-60: The homeowner waits. The insurance company processes paperwork. They hope you cash the check.

Day 60-90: The homeowner finally looks for a contractor. But wait—SB 153 makes it illegal for contractors to answer the phone.

Day 90+: The contractor is finally allowed to speak to the homeowner. But by now:

- The insurance claim is closed.

- The homeowner has already spent the initial payment.

- The statute of limitations on suing for underpayment is ticking.

Result: The insurance company controls the price from start to finish. The free market is eliminated.

The “AOB” Boogeyman: Is There Real Fraud?

Insurance lobbyists argue that contractors use Assignment of Benefits (AOB) agreements to inflate prices and sue insurers.

Is this real? Yes, in limited cases, particularly in Florida, abuse occurred. Contractors would buy homeowners’ claims for a few hundred dollars, then sue insurers for six-figure sums.

Is this happening in Kentucky? Rarely. And SB 153 isn’t tailored to stop fraud. It is a blunt instrument that punishes every honest contractor and every homeowner who wants a fair price.

True consumer protection would target bad actors. SB 153 targets competition.

The Economic Impact: What SB 153 Costs You

Let’s look past the political rhetoric and focus on your wallet.

1. You Lose Leverage

Right now, if your insurance adjuster says your roof is worth $8,000 and a contractor says it’s worth $12,000, you have power. You can submit the contractor’s bid and negotiate.

Under SB 153, you can’t get that bid. You take the $8,000.

2. Delayed Repairs Lead to More Damage

Water doesn’t wait 90 days. If your roof is actively leaking, waiting three months for a solicitation to be legal means you wait three months for a tarp. Meanwhile, mold grows. Who pays for that? You do, via increased premiums and higher deductibles.

3. Small Businesses Collapse

Local roofing and restoration companies operate on thin margins. They rely on rapid response to keep crews employed. A 90-day work stoppage following a major storm doesn’t stop fraud—it bankrupts local businesses, leaving the market solely to large, out-of-state insurers.

National Precedent: The Florida Disaster

Kentucky is not the first state to consider this. Similar bills have been defeated in Texas and challenged in Louisiana.

Florida passed restrictive anti-solicitation laws. Did premiums go down?

No. Florida homeowners now pay the highest property insurance premiums in the nation. Insurers took the cost savings from reduced claims payouts and pocketed them. They did not pass them to consumers.

There is zero evidence that banning contractors lowers premiums. There is overwhelming evidence that it lowers competition.

The Constitutionality Question

SB 153 isn’t just bad policy; it may be illegal.

Contractors earn a living through speech—advertising, knocking on doors, calling leads. The First Amendment protects commercial speech.

Does the government have a right to ban a roofer from talking to a homeowner for 90 days?

Courts have historically struck down blanket bans on truthful advertising. SB 153 bans any solicitation, regardless of whether the contractor is honest, licensed, or offering a fair price. This is content-based suppression of speech.

If SB 153 passes, it is almost certain to face a federal lawsuit.

What You Can Do

If you live in Kentucky, this bill is currently moving through committee. Here is how to fight it:

1. Identify the sponsors.

Look up who is carrying SB 153. If they are in your district, call them. Tell them you oppose government-mandated monopolies.

2. Ask the hard questions.

When you hear a legislator say “this stops fraud,” ask them:

- “Why 90 days? Why not 10 days?”

- “If this is about bad contractors, why not pass stronger licensing laws instead of silencing everyone?”

- “Will you guarantee my premiums go down?”

3. Share your story.

Have you ever been lowballed by an insurance adjuster? Did a contractor save you money by finding damage the insurance company missed? That story defeats a lobbyist every time.

Conclusion: Who Wins?

If SB 153 passes, the only winner is the insurance industry.

They will pay out less per claim. They will face less litigation. And they will face zero competition in the critical first 90 days following a disaster.

The losers are:

- Kentucky homeowners, who will repair less of their homes for more money.

- Kentucky contractors, who will lose their livelihoods.

- The free market, which relies on information and choice.

This isn’t consumer protection. It is corporate protectionism.