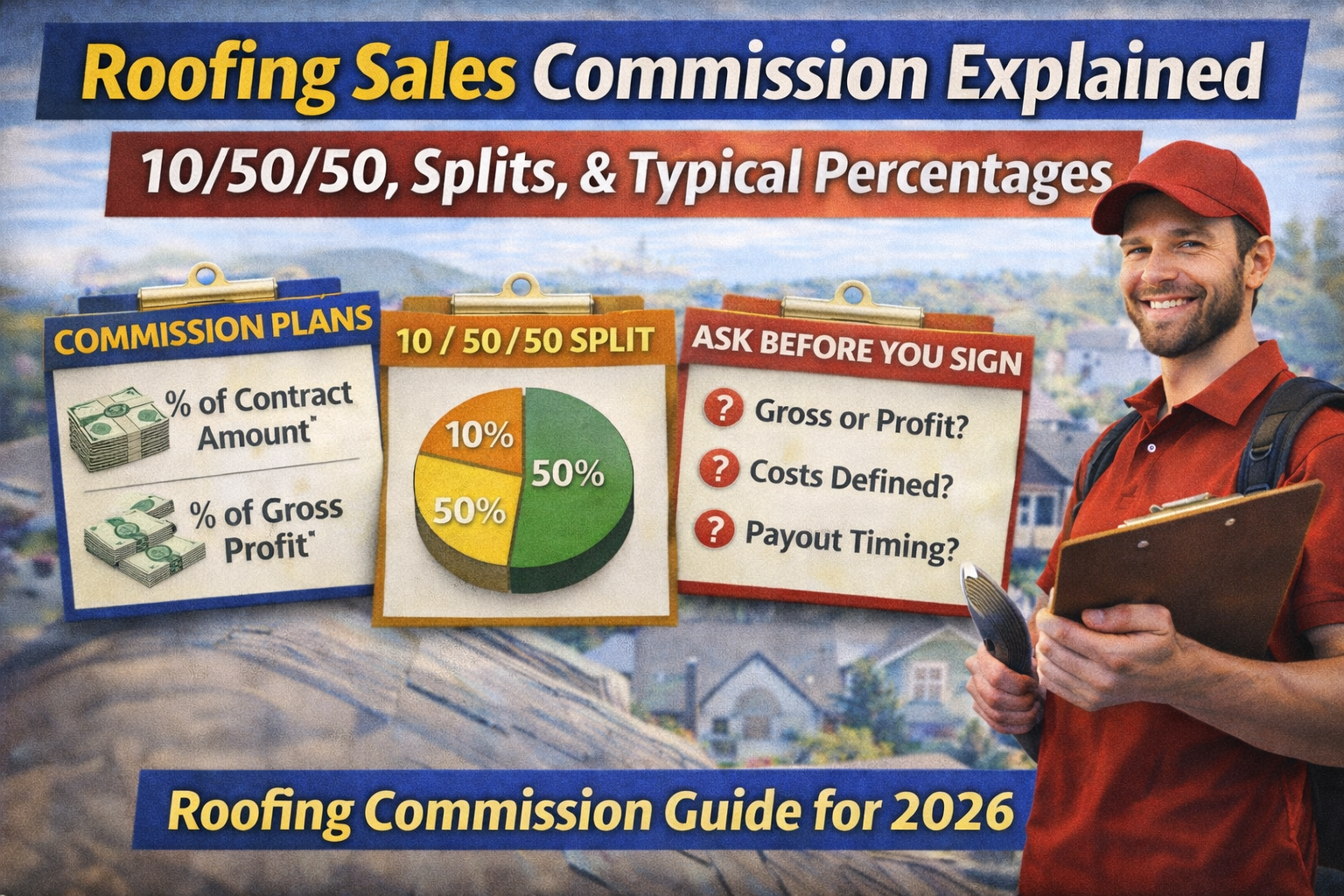

Roofing sales commission can look simple—until you realize two companies can both say “10% commission” and mean two completely different things.

In 2026, the most common roofing commission plans fall into a few buckets:

- Percent of gross (contract amount)

- Percent of gross profit

- Profit splits (like 10/50/50 or 50/50)

- Tiered plans and bonuses

This guide explains each model, shows real math examples, and helps you spot the fine print that determines what you actually take home.

The 3 numbers you must understand first

Before you compare any commission plan, you need these definitions:

1) Gross (Total Contract Value)

The full job amount on the contract (example: $20,000 roof).

2) Gross Profit (GP)

Gross minus direct job costs (labor, materials, disposal, subs, etc.).

Example: $20,000 contract – $12,000 costs = $8,000 GP. Contractors Cloud+1

3) Net Profit

Gross profit minus overhead (office, admin, marketing, vehicles, insurance, etc.).

This is where many “profit split” disputes come from—because “profit” isn’t defined the same everywhere. Hook Agency+1

Typical roofing sales commission percentages in 2026

These are commonly cited ranges (always confirm what the base is—gross vs profit):

If you’re paid on gross sales

A common range is ~5% to 12% of gross. blog.theroofstrategist.com+1

If you’re paid on profit (gross profit / margin)

A common range is ~30% to 50% of profit. blog.theroofstrategist.com+2blog.theroofstrategist.com+2

You’ll also see 8–10% of total as a “flat-rate” example in general discussions. RoofClaim

Important reality check: Insurance jobs often have tighter margins than retail work, so the same commission plan can feel very different depending on the mix. Hook Agency

Commission Model #1: Percentage of total revenue (gross)

How it works:

You earn a flat percentage of the contract amount (or sometimes collected revenue). Contractors Cloud+1

Example:

- Contract: $20,000

- Commission: 10%

- Rep earns: $2,000

Pros

- Simple and predictable

- Great for new reps (easy to understand)

Cons

- Can reward bad pricing (discounting still pays the rep)

- Doesn’t protect margins unless the company enforces pricing rules Contractors Cloud

Commission Model #2: Percentage of gross profit

How it works:

You earn a percentage of the gross profit (contract minus direct job costs). Contractors Cloud+1

Example:

- Contract: $20,000

- Costs: $12,000

- Gross profit: $8,000

- Commission: 25% of GP

- Rep earns: $2,000 Contractors Cloud

Pros

- Aligns rep behavior with margin

- Encourages upsells and clean pricing

Cons

- Requires accurate job costing (or reps will distrust numbers)

- Can create disputes if costs are unclear or change late Contractors Cloud

Commission Model #3: The 10/50/50 plan (profit split)

This is one of the most talked-about plans in roofing.

How it works (typical version):

- Take 10% of the contract off the top for overhead

- Subtract job costs

- Split remaining profit 50/50 between company and rep Hook Agency+1

Example math (from common explanations):

- Contract: $10,000

- Overhead set-aside (10%): $1,000 → remaining $9,000

- Job cost: $7,000

- Profit remaining: $2,000

- Rep gets 50%: $1,000 commission Hook Agency+1

Another common example shows:

- $10,000 contract

- $5,400 cost

- 10% overhead ($1,000)

- Remaining profit $3,600

- Rep gets 50% = $1,800 Hook Agency

Why people like it

- Reps feel like “partners” because they share profit

- Strong incentive not to sell junk deals

Why it can break

- If overhead is more than 10%, the company can get squeezed

- If “costs” aren’t controlled, profit shrinks and reps feel cheated

- If “profit” isn’t clearly defined, disputes are guaranteed Hook Agency+1

There are also industry voices arguing that giving away 50% of profit can be hard to sustain for the business unless everything else is dialed in. Hook Agency+1

Commission Model #4: 50/50 split (and other split variations)

Some companies do a straight profit split without the “10% overhead” step.

Key warning: If you ever hear “50/50 profit split,” your first question must be:

“Profit” according to which definition—gross profit or net profit, and what expenses are included?

If it’s not defined in writing, assume problems later. youtube.com

Commission Model #5: Tiered commissions and bonuses

Tiered plans increase commission when you hit targets (volume or margin). Contractors Cloud

Example (margin tier):

- <35% margin → 20% of GP

- 35–45% margin → 25% of GP

- 45%+ margin → 30% of GP Contractors Cloud

These are popular because they push reps toward quality sales, not just quantity.

The payout timing trap: when do you actually get paid?

Even a great commission rate can feel terrible if payouts are slow.

Common payout triggers:

- At contract signing

- At materials delivery / start

- At completion

- After final collection (often safest for the company)

Ask this directly, because it determines your cash flow.

What to ask before you accept a roofing commission plan

Copy/paste these questions:

- Is commission based on gross, gross profit, or net?

- If profit-based: how are job costs tracked and verified?

- What exactly counts as “commissionable revenue”—do supplements/change orders count?

- When do commissions pay out (and can they be clawed back)?

- What happens if a job cancels or the customer doesn’t pay?

- Are leads provided, and does lead source change commission rate?

- What support is included (training, CRM, marketing, appointment setting)?

Bottom line: what’s “fair” for roofing commissions?

“Fair” is less about the headline percentage and more about:

- lead quality and who generates it

- the margin of the work (retail vs insurance)

- the support you receive (setter, canvassers, estimator, supplements, production)

- clear definitions and payout timing

A clean plan is one where everyone can predict the outcome before the job starts.

Want a second opinion on a commission plan?

Allied Emergency Services, Inc.

Phone: 800-792-0212

Email: info@alliedemergencyservices.com