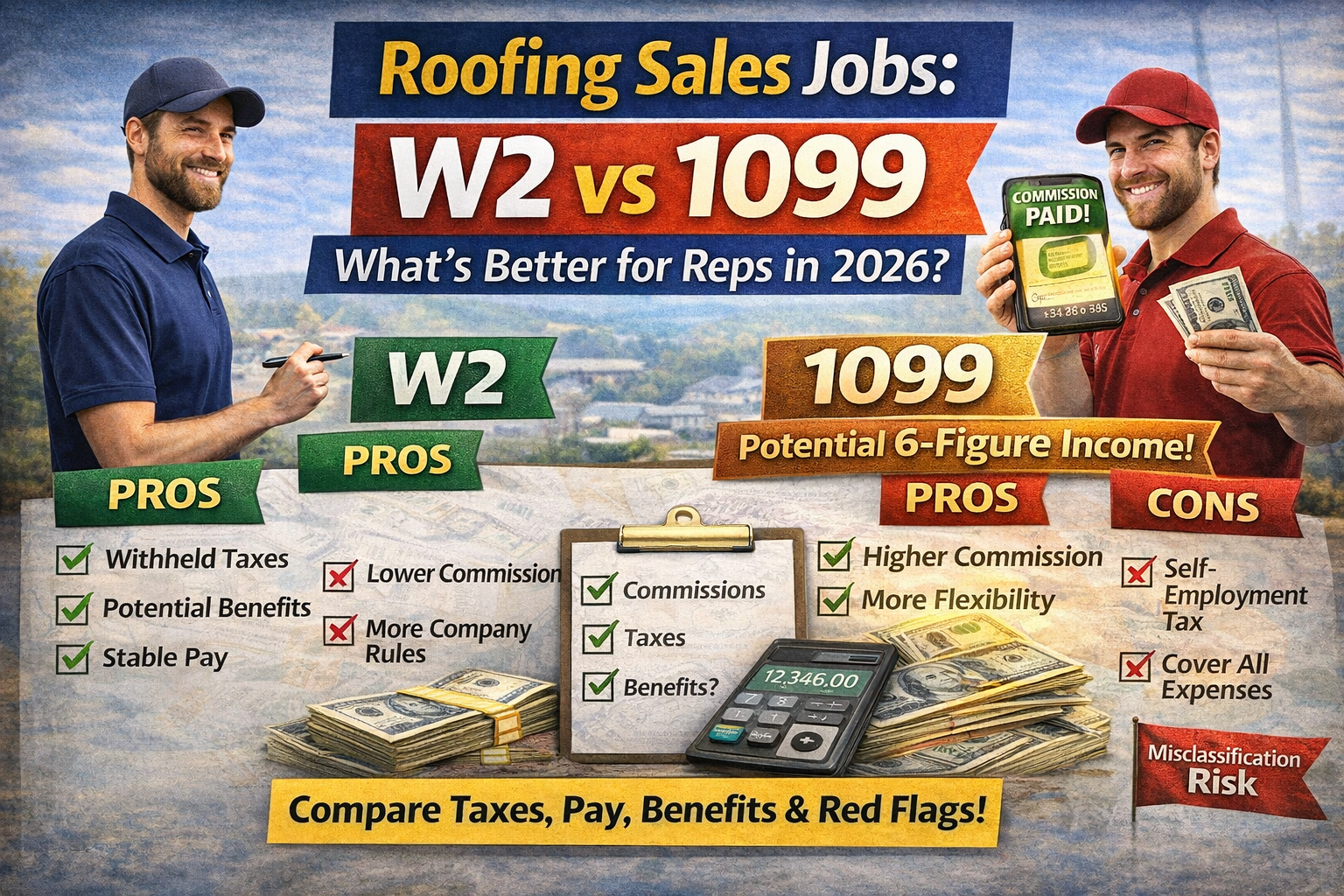

If you’re interviewing for roofing sales jobs, you’ll quickly run into a big fork in the road: W2 employee or 1099 independent contractor.

Neither is automatically “better.” The right choice depends on your risk tolerance, your lead source, how much control the company has over your work, and what your real take-home pay looks like after taxes, benefits, and expenses.

Below is a practical 2026 guide for roofing reps—especially door-to-door and storm restoration.

Quick definitions: W2 vs 1099

W2 (Employee)

You’re on payroll. Your employer reports your wages on a W-2 and withholds payroll taxes. IRS+1

1099 (Independent contractor)

You’re self-employed (or operating through a business entity). You’re typically paid gross and handle your own taxes and insurance.

A key difference: 1099 contractors generally owe self-employment tax (Social Security + Medicare) of 15.3% on net earnings (with some limits and rules). IRS

The question reps should ask first: “Is this classification even legal for this role?”

A lot of roofing sales roles look like 1099 because they’re commission-based. But commission-based doesn’t automatically mean “contractor.”

The IRS emphasizes that classification depends on the relationship and degree of control/independence, commonly grouped into behavioral control, financial control, and the relationship of the parties. IRS+1

Big Illinois-specific caution (construction industry)

In Illinois construction, worker misclassification is a known issue. Illinois’ Employee Classification Act (820 ILCS 185) presumes individuals performing services for a construction contractor are employees unless specific tests are met. Illinois General Assembly+1

Section 10(b) includes an “ABC-style” test (free from control, outside the usual course of the contractor’s business, and independently established trade/business). Illinois General Assembly+1

Why this matters to roofing reps: If a company is controlling your schedule, process, scripts, territories, and day-to-day like an employee—but paying 1099—that’s a red flag for you and them.

W2 roofing sales jobs: pros and cons for reps

Pros

- Payroll taxes handled (you’re not paying both halves of Social Security/Medicare like a true self-employed person). IRS+1

- Often includes workers’ comp, unemployment coverage, and potential benefits (varies by employer).

- Usually easier to qualify for loans/mortgages with stable pay stubs.

Cons

- Lower “headline” commission % sometimes (because the company carries more overhead/benefit costs).

- More rules: required meetings, schedules, mandatory territory coverage, etc.

Best fit for: newer reps, people who want stability/training, and reps who don’t want the admin burden of running themselves like a business.

1099 roofing sales jobs: pros and cons for reps

Pros

- Potential for higher commission splits if the company truly treats you like an independent business.

- More flexibility (when it’s legitimate): you run your schedule, approach, and pipeline.

- Possible tax advantages only if you have real business expenses and keep clean books (talk to a CPA).

Cons (the stuff that surprises people)

- You’re responsible for taxes, and self-employment tax can be significant (15.3% on net earnings, subject to rules). IRS

- You may need to pay your own health insurance, liability, vehicle, phone, software, etc.

- Cash flow can be rough if commissions pay only after completion/collection.

Best fit for: disciplined reps with savings, strong self-generation, and the ability to operate like a real independent business.

The “real math” checklist: compare offers the right way

Before choosing W2 vs 1099, compare these apples-to-apples:

- Lead source

- Company-provided leads? Your commission should reflect that.

- Self-generated? You should keep more of the upside.

- Commission basis

- Percent of contract? Profit split? “Net” after adjustments?

Get it in writing.

- Pay timing

- Paid at contract, at start, at completion, or after collection?

- Your monthly expenses

- Gas + vehicle wear

- Phone + data

- CRM/app costs

- Tools (ladder, measuring, PPE)

- Marketing (if you’re expected to buy your own leads)

- Taxes

- W2: withheld automatically, simpler.

- 1099: plan for self-employment tax + income tax. IRS

A “higher commission” can still lose if you’re paying for everything and waiting 60–120 days for collections.

Red flags in roofing sales job postings (W2 or 1099)

- “1099” but they require set hours, mandatory meetings, scripts, uniforms, territories, and daily activity reporting (control-heavy). IRS control factors matter. IRS+1

- Vague pay plan: “uncapped commissions” with no definition of commissionable revenue.

- You must buy leads upfront or pay for training kits to “unlock” work.

- They discourage written terms or say “we’ll explain after you start.”

Which is better for roofing reps in 2026?

Choose W2 if you want:

- stability + training runway

- lower tax/admin burden

- a structure that’s closer to a career track

Choose 1099 if you want:

- maximum upside and true independence

- you can handle taxes, expenses, and delayed payouts

- you already know how to generate leads and close

If you’re unsure, a safe approach is: start W2, build skills + savings, then consider 1099 only when you’re truly operating like a business.

Want a second opinion on a pay plan?

Allied Emergency Services, Inc.

Phone: 800-792-0212

Email: info@alliedemergencyservices.com

Apply: https://www.careers.alliedemergencyservices.com/job/chicago-area-roofing-sales-rep-high-commission