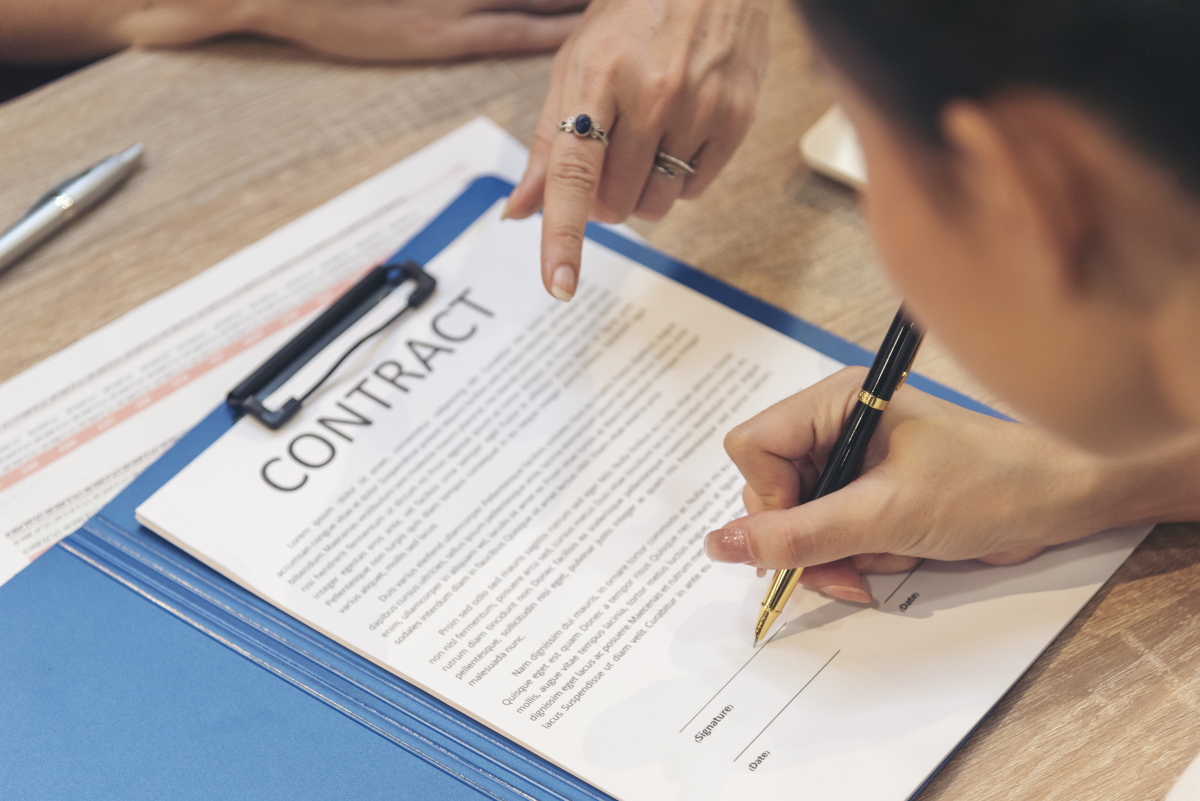

When it comes to insurance restoration claims, understanding the contract types available is crucial. In this blog post, we’ll discuss the three most common contract types: Assignment of Benefits, Home Remodeling Contracts/Proposals, and Contingency Agreements. We’ll cover the pros and cons of each, so you can make informed decisions when working with a restoration contractor and always consult with an attorney if you need legal advice. This is not legal advice.

Assignment of Benefits (AOB)

An Assignment of Benefits contract allows the policyholder to assign their insurance claim benefits directly to a restoration contractor. This type of agreement can streamline the restoration process and ensure that the contractor receives payment for their work while eliminating or reducing any financial responsibility of the homeowner.

In this situation, the insurance company is the buyer because

they are providing the funds for the repair services through the insurance claim. The company is the seller because they are providing the repair services in exchange for payment from the insurance company.

It is generally in the property owner’s best interest to assign their insurance benefits to a company providing repair services because it allows them to receive the services without having to pay out of pocket. Without the assignment of insurance benefits, the property owner will be responsible for paying for the repair services themselves. This will include unknowns that commonly surface after repairs begin which is very common during roof replacement and insurance restoration.

Pros:

- Streamlines the payment process

- Reduces delays in starting the project

- Ensures contractor receives payment

Cons:

- Loss of control over some parts of the insurance claim

- Potential for disputes between the contractor and the insurance company

Home Remodeling Contract/Proposal

A Home Remodeling Contract or Proposal is a detailed agreement between the homeowner and the contractor outlining the scope of work, materials, costs, and timelines for a restoration project. This type of contract is commonly used for non-insurance related restoration projects or for projects where the homeowner wants more control over the process.

Pros:

- Detailed outline of work and costs

- Clear expectations for both parties

- Allows for more control by the homeowner

Cons:

- Generally requires much negotiation and many revisions

- The homeowner is responsible for managing insurance claim reimbursement

- More complex paperwork and administrative tasks required of homeowner

- Homeowner personally assumes the debt and financial responsibility of the services regardless of insurance claim outcome

- Homeowners lack of experience can be detrimental to their claim

Contingency Agreement

A Contingency Agreement is a contract between the homeowner and the contractor that states the contractor will perform the restoration work if the insurance claim is approved. This type of contract is often used when the scope of work and costs are uncertain or dependent on insurance approval.

Pros:

- Allows for flexibility in project scope and costs

- No upfront payment or commitment required

- Encourages contractor to work with you and your insurance company

Cons:

- Uncertainty in project scope and costs until insurance approval

- Potential for disputes if insurance payout is lower than expected or lawfully required items are omitted

- Less control for the homeowner and the contractor in the restoration process

Understanding the three main types of contracts in insurance restoration claims is essential for homeowners navigating the restoration process. By knowing the pros and cons of Assignment of Benefits, Home Remodeling Contracts, and Contingency Agreements, you can make informed decisions and choose the best contract type for your situation. Always consult with a trusted restoration contractor and legal advisor before signing any contracts to ensure you fully understand your rights and obligations. If you are in need of restoration service or consultation please call us today at 1-800-792-0212 or visit www.alliedemergencyservices.com

#InsuranceRestoration #HomeownerTips #InsuranceClaims #StayOnTop